retroactive capital gains tax hike

Not only does he want to raise taxes on capital gains to a modern high of 434 he wants to do it retroactively. Retroactive Capital Gains Tax Hike On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive to April.

Biden Tax Plan And 2020 Year End Planning Opportunities

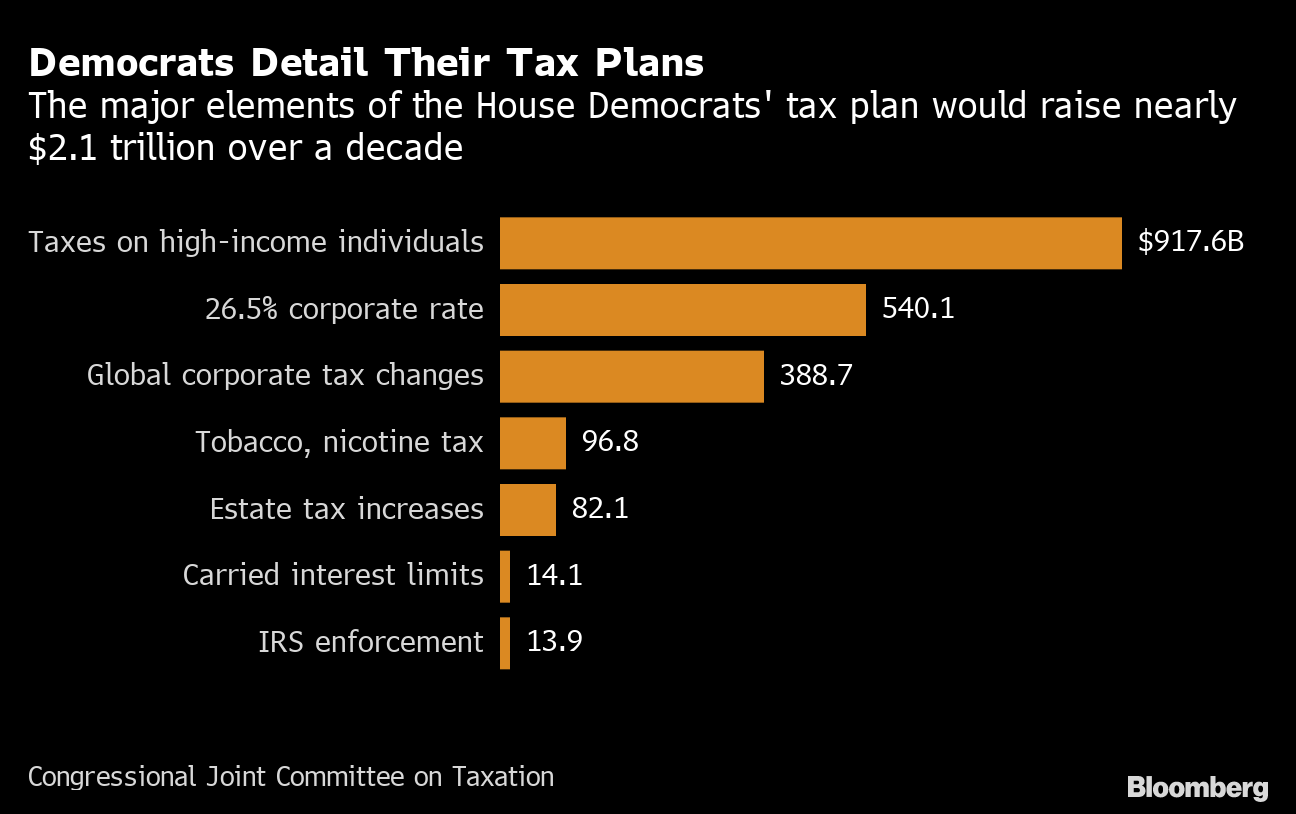

And remember that the capital gains hike isnt the only tax increase proposed for the near future.

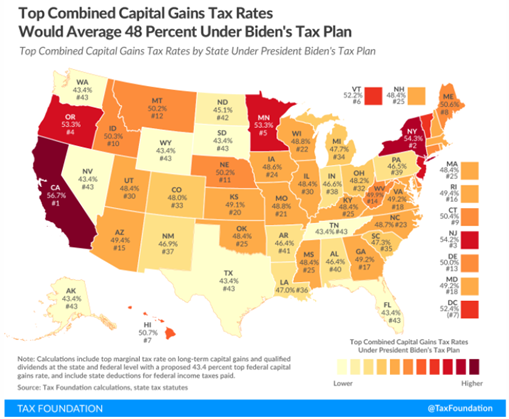

. The Presidential Administration made a huge splash earlier this year when. Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of the year would have. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates.

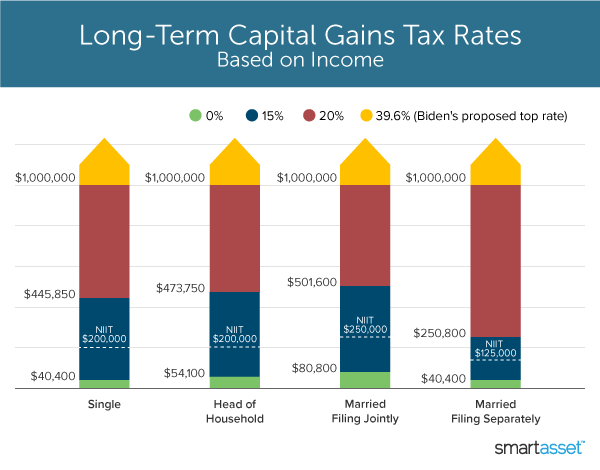

The clients capital gains would be taxed at their ordinary income marginal tax rate which is 37 for 2021 but would rise to 396 in 2022 under the Biden budget plus the 38. 2 Proposed Biden Retroactive Capital Gains Tax National axpayers Union ondation Could Be Challenged on Constitutional Grounds levying a 10 percent surtax on high earners6 imposing a. The American Families Plans proposed tax rate of 434 on capital gains is the highest tax rate on long-term capital gains in the past 100 years and the largest increase in the.

Retroactive Capital Gains Tax Hike. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive. President Biden has proposed increasing the top 238 capital gain rate to 434 a staggering 82 increase.

Whether or not the capital gains tax increase is retroactive the effects on investing and tax planning could be dramatic. President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive.

The 1993 Clinton tax increase raised the top two income tax rates to 36 and 396 with the top rate hitting joint returns with incomes above 250000 400000 in 2012. This resulted in a 60 increase in the capital gains tax collected in 1986. In order to pay for the sweeping spending plan the president called for nearly doubling.

If the effective date is retroactive to April 2021 it will be too late for investors to sell to avoid the tax increase. How a Retroactive Capital Gains Tax Hike Can Impact Nonprofits 06042021 4 minute read. Then there is timing.

Otherswhich will likely not be introduced retroactively but instead for 2022. Top earners may pay up. Whereas under the Green Book proposal that same 10 million gift.

The Biden proposal would raise the top marginal rate to 396 percent beginning December 31 2021 for couples with over 509300 in taxable income. As of 2021 the lifetime gift tax exclusion is 117 million per individual and 234 million per married couple. The 1987 capital gains tax collections were slightly below 1985.

The capital gain hikes. As proposed the rate hike is already in effect. Donors will be able to give gifts without realization if the estate provisions take effect after 20 See more.

The maximum rate on long-term capital. The proposed budget would increase the taxes on capital gains for Americans earning more than 1 million to 434 which makes the rate the same as these individuals. The retroactive aspect of the tax hike is a tacit admission that such a large tax hike is likely to change investor behavior as taxpayers seek to avoid paying such an elevated.

President Biden really is a class warrior. BIDENS PLANNED CAPITALS GAINS TAX HIKE COULD SLASH US REVENUE BY 33B.

Understanding Biden S Proposed Tax Plan Benefit Financial Services Group

Richest Americans Want Clarity On Tax Hikes So They Can Avoid Them Bloomberg

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

Governor Brown S Tax Proposal And The Folly Of California S Income Tax Tax Foundation

Wall Street Panicking That Biden S Tax Hikes Will Be Retroactive

The Capital Gains Rate Historical Perspectives On Retroactive Changes Lexology

Biden To Impose Largest Tax Increase Since 1968 Americans For Tax Reform

What S In Biden S Capital Gains Tax Plan Smartasset

Advisors Look For Ways To Offset Biden S Retroactive Capital Gains Tax Hike

How To Prepare For A Retroactive Capital Gains Tax Hike Thinkadvisor

An Overview Of Capital Gains Taxes Tax Foundation

Managing Tax Rate Uncertainty Russell Investments

Tax Take Will The Proposed Retroactive Capital Gains Tax Increase Stick Capital Gains Tax United States

Managing Tax Rate Uncertainty Russell Investments

Yellen Argues Capital Gains Increase From April 2021 Not Retroactive Bloomberg

Advisers Blast Biden S Retroactive Capital Gains Proposal

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk